Case Study 1

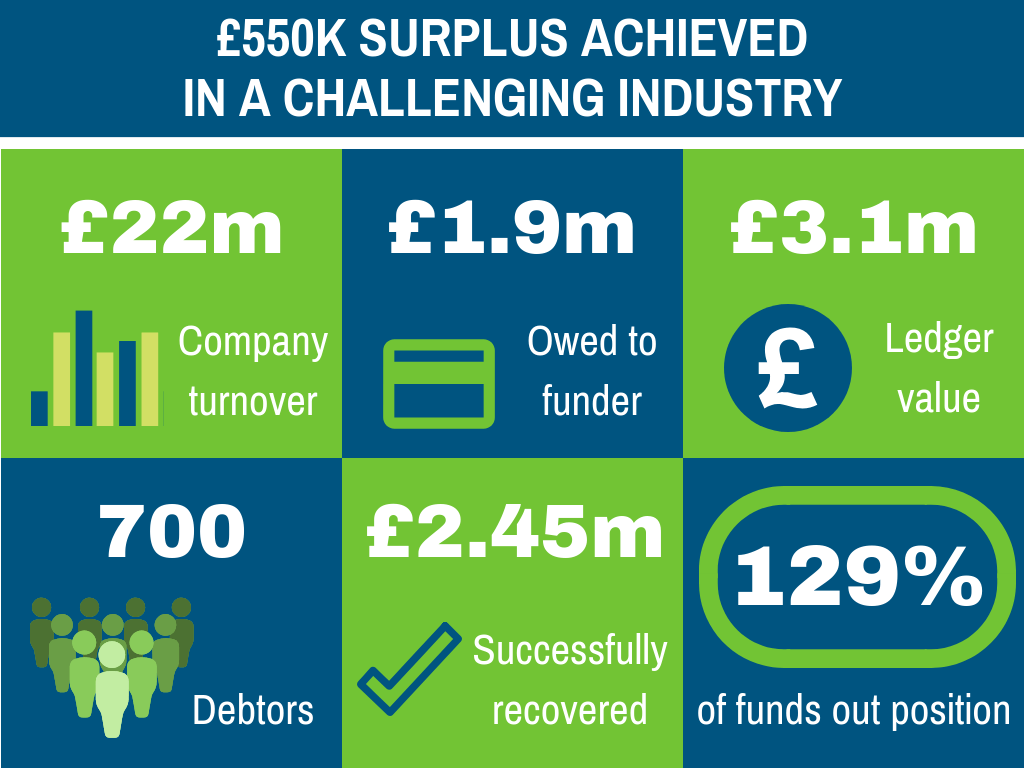

£550K surplus achieved in a challenging industry

summary

We successfully recovered 129% of the Funds Out position on behalf of a major Funder when a North Devon Toiletries company became insolvent. We previously helped them improve their financial position when they were still trading, implemented credit control procedures and recruited staff.

Facts – Phase 1

The family-run toiletries business had grown from £12m to £22m in 12 months and was making a substantial loss whilst doing so, as internal controls were extremely poor.

They owed £3.2m on their Invoice Finance Facility and had a £1m overdraft.

We were instructed by the Bank’s Invoice Finance Team as well as the Main Bank and an Insolvency Practitioner to get the ledger management under control and reduce the overdue debt as soon as possible.

Once this was completed it was agreed that we would create a Credit Policy and Procedures Manual and assist with implementation as well as staff recruitment.

actions – Phase 1

Credebt engaged directly with the company and took over the ledger in its entirety at no cost to the Invoice Finance Company. We spent 3 months maximising the cash collection whilst reviewing and reducing all bottlenecks within the order to cash process.

Two members of our team were on site several times each week to work through queries. Remote access to invoice, pod and bank systems were obtained to work as efficiently as possible.

We met up with some of the largest customers to assist with query resolution and we set up an adequate and effective Query Management System.

For the first month, we reported back to the IF Company daily, and weekly after that. We had conference calls or physical meetings to go through issues every morning at 10am for the first four weeks, and at least twice a week after that.

Results – Phase 1

We collected £9m in 3 months, whilst reducing the Invoice Finance Facility down to £1.8m. Queried invoices were reduced from £1.5m to £212K.

We wrote a robust Credit Policy and Procedures, which ensured the company was invoice finance compliant. We assisted with monthly reconciliations and repaired the relationship between the company and the invoice finance provider.

We helped them recruit 2 Credit Control staff, using our expertise to find the right people for the job. We conducted the interviews and prepared their job specifications.

We exited the business after nearly 4 months as they were now in a position to successfully cope themselves.

Unfortunately, due to a number of other challenges they faced, some five months after we stopped assisting the business, an accelerated sales process was commenced by the IP which ultimately resulted in the business entering Administration, with the buyer not interested in purchasing the Debtor Book. We were then re-engaged for the Collect Out.

facts – Phase 2

On the day we were re-instructed the Invoice Funds Out position was £1.9m with a £3.1m ledger.

actions – Phase 2

We visited the site and obtained all the books and records for the collect out.

We started the pre-appointment credit control and managed the Invoice Funds Out position down to £1.3m and the sales ledger down to £2.5m.

results – Phase 2

Within 3 months of Administration, we recovered £1.85m. This resulted in the IF position being fully recovered and a healthy £550K surplus transferred across to the Main Bank debt.

Together with the £600K pre-appointment collections, this brought the total collected to £2.45m, which is 129% of the initial Funds Out Position. The rest of the ledger was intercompany or invoices with genuine queries against them.

The Main Bank debt was also secured against group property, so both divisions of the bank recovered their capital in full and were delighted with the result.

£2.45 Million Recovered

%

of Funds Out

How can we help?

Credebt provide a full range of expert Receivables Management Solutions to the Insolvency Profession, the Invoice Finance Industry, Turnaround Practitioners, advisers and their clients, from full sales ledger recovery to outsourced credit control.

For more information about how we can help call 08456-6385256

or email our MD, Glen Morgan at glen@credebt.co.uk

“We have instructed Credebt on several cases and have always been pleased with the results achieved, which have been particularly cost-effective.”

our offices

Bristol Office

Credebt Ltd

Trym Lodge

1 Henbury Road

Westbury-On-Trym

Bristol

BS9 3HQ

Manchester Office

Credebt Ltd

2nd floor

3 Hardman Square

Manchester

M3 3EB

London Office

Credebt Ltd

Hamilton House

Mabledon Place

London

WC1H 9BD

Credebt Limited: Registered in England Number: 6933734 Registered Office: Trym Lodge, 1 Henbury Road, Westbury on Trym, Bristol BS9 3HQ

Data Protection License Number: Z1837677 | Credit Services Association Membership number: 804