summary

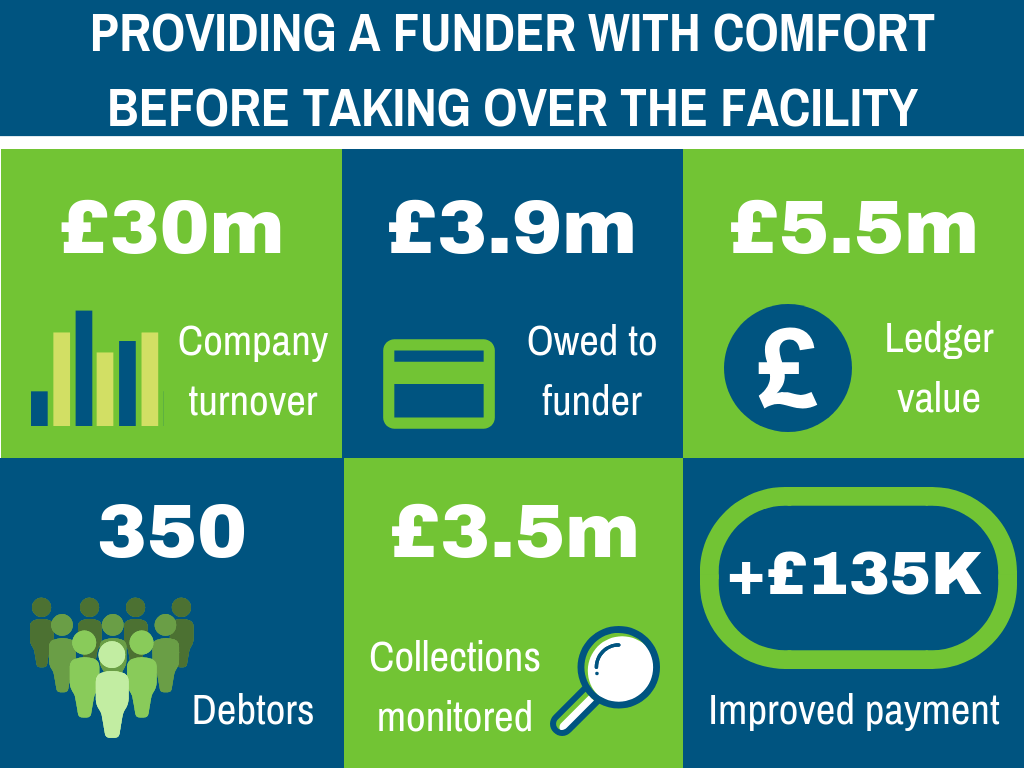

We successfully monitored collections for the Administrator of a Glass company, and managed to get them a £135K higher payment than proposed.

Facts

This £30m turnover glass industry was in distress and planning to go into Administration. The existing Funder wouldn’t support the business post administration, so they were looking for a new Funder that would.

We were instructed by the first potential new Funder to value the Ledger and look at multiple possible scenarios including:

- Liquidation, no new buyer

- Trade buyer, going concern

- Trade buyer, Administration

- Management Buy Out from Administration

actions

We reviewed and audited the Order to Cash process and produced a Report showing the collectability of the £5.5m Ledger with a £3.9m Funds Out position.

We carried out an extensive verification exercise to ensure the potential new Funder was comfortable with the level of verified Debt prior to buying out.

The first Funder couldn’t get credit approval for taking on the Ledger, so we reported to two further Funders who were interested, all at no charge to them.

One of them bought the Ledger and agreed to fund the New Company, as well as take on the Collection of the Ledger with their in-house Collection service.

We were instructed by the Administrator to monitor the Collections and ensure the Collection performance was adequate. We were also asked to advise when the surplus was reached and exceeded, and payment was therefore due to into Administration.

The New Company proposed a deal to purchase the surplus Ledger with a £50K payment on day one and a 70:30 split thereafter.

Results

The Funder was repaid in full prior to Administration, with a minimum of fuss.

We advised the Administrator to get a better deal from the New Company and they ended up agreeing to pay £200K on day one and an 80:20 split thereafter, resulting in the Administrator getting £135K more than they would have with the original deal.

This is an example where Credebt ended up taking only a small fee for the Monitoring of the Collections. Long term relationships are very important to us and we continue to work with this Insolvency Practitioner, and all the Funders that we dealt with on this occasion.

£135K more achieved

%

Improvement

How can we help?

Credebt provide a full range of expert Receivables Management Solutions to the Insolvency Profession, the Invoice Finance Industry, Turnaround Practitioners, advisers and their clients, from full sales ledger recovery to outsourced credit control.

For more information about how we can help call 08456-6385256

or email our MD, Glen Morgan at glen@credebt.co.uk

“Glen and his team are just what’s required in a distressed debt recovery situation. I’ve worked with them on a number of occasions and am very comfortable in handing them over a ledger and letting them get on with the collection process, always with a better result than I could achieve internally.”

our offices

Bristol Office

Credebt Ltd

Trym Lodge

1 Henbury Road

Westbury-On-Trym

Bristol

BS9 3HQ

Manchester Office

Credebt Ltd

2nd floor

3 Hardman Square

Manchester

M3 3EB

London Office

Credebt Ltd

Hamilton House

Mabledon Place

London

WC1H 9BD

Credebt Limited: Registered in England Number: 6933734 Registered Office: Trym Lodge, 1 Henbury Road, Westbury on Trym, Bristol BS9 3HQ

Data Protection License Number: Z1837677 | Credit Services Association Membership number: 804