Credit Control Process Letters

Having a robust Credit Control Policy is essential for every business owner, however large or small.

As part of this policy, you will need various Credit Control Process Letters to help you manage your payments. At Credebt we are experts in the field of collecting money, and we are happy to share our resources with you to help you improve your cashflow.

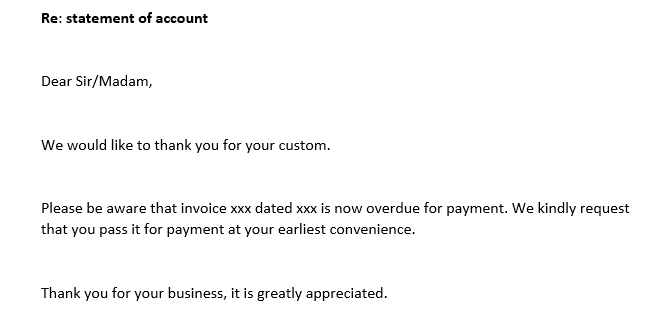

Credit Control Letter 1: a gentle reminder

When the invoice is overdue, you need to send out this first letter (or email) to remind your customer of this fact.

Here is a short preview of the letter. Click on the image to download a Word document that you can use in your business.

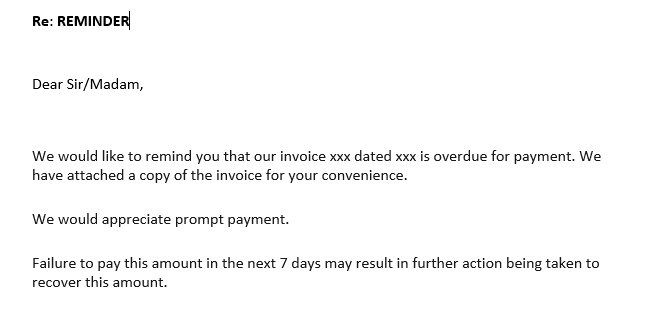

Credit Control Letter 2: a firm reminder

One week after sending letter 1, and when the debt remains unpaid, you’ll need to send out letter number 2, together with a copy of the invoice. This can be sent by email, but also needs to be sent by post.

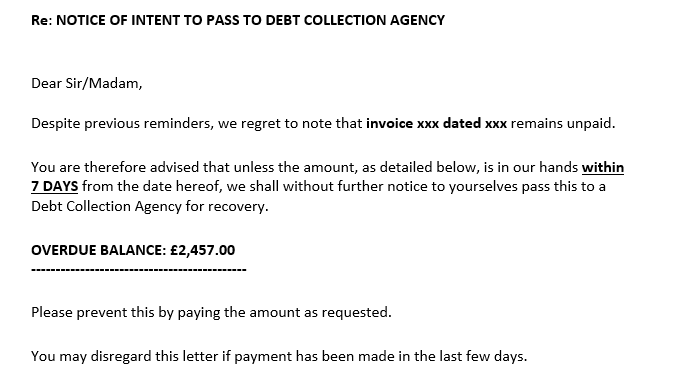

Credit Control Letter 3: Notice of intent to pass to Debt Collection

When the debt remains unpaid 15 days after sending the previous letter, you have to get more serious.

It is time to send out a letter signalling your intent to pass the debt to a Debt Collection Agency. Only do this if you are willing to take the action required if your customer doesn’t pay. Even though most invoices are paid before you have to do this, it is no good making empty threats.

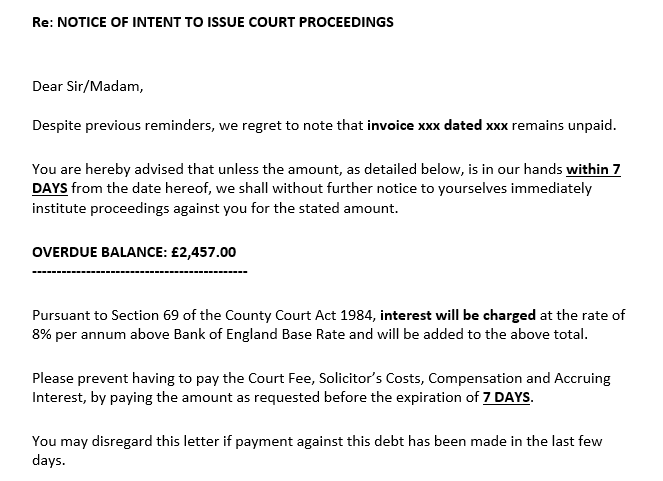

Credit Control Letter 4: Letter before Action

If, instead of passing the debt to a Debt Collection Agency, you intend to take action yourself, it is time to send out an LBA informing your customer of your intentions.

The same principle as with the previous notice applies: only threaten to do this if you are willing to go through with it.

How can we help?

Remember that Credebt are the experts in this field and we are more than happy to help you with any issues you or your clients may have.

Feel free to contact us for a no obligation chat in total confidence, or arrange your Free Debtor Collateral Review to find out your Position.

Call us on 0845-6385256 or email info@credebt.co.uk