In this scenario we follow a 4-stage process as detailed below, which is proven to maximise realisations in a Collect Out.

Stage 1: Debtor Collateral Review

Following an initial conversation, we always suggest that the first step is to get us out to site to carry out a comprehensive Debtor Collateral Review. We do this initial review at NO CHARGE to you, regardless of the outcome. It includes:

On-site visit usually within 24 hours but guaranteed within 48 hours to secure the following:

-

Copy invoices

-

System access

-

Details of any issues and queries

-

Backing paperwork

-

Aged Debt reports

-

Customer Master File

These are all required to Prepare for Collect Out

Whilst on-site, we tidy up the Ledger and immediately produce a report which indicates the true collectability of the Ledger, which can be used when producing any Statement of Affairs.

This can only be accurately assessed once the Order to Cash process has been fully understood, which is why it takes experts to do this.

We also review Aged Creditors, Contras and other issues that may impact collectability and leave no stone unturned in reaching a realistic figure for Collections.

At this point we will also decide if any staff still on site can be of use with the Collections Process, as our main aim is to recover the maximum amount for Creditors as soon as possible, with the minimum of fuss.

THERE IS NO CHARGE FOR THIS INITIAL VISIT, REGARDLESS OF OUTCOME

Please note that if, for any reason, the Insolvency doesn’t happen, this service is free and always will be. And even if the Insolvency does happen and we don’t end up dealing with the Ledger, this service is still free of charge.

Stage 2: Prior to Collect Out

We will agree a No-Win-No-Fee with you and discuss whether you would prefer to have Bad Debt Protection in place, which will aid in maximising Collections.

Our fee structure is incredibly flexible and can be:

-

One No-Win-No-Fee percentage agreed on all Collections

-

A Tiered Fee based on milestones agreed with you

-

A Low Percentage Fee until we reach a certain milestone or Funds Out position if a Funder or Bank is involved, and then increased once a surplus is achieved or milestone passed

-

In certain circumstances, we have even agreed to work for free until a surplus or milestone is achieved and then charged a higher Fee after that.

This variety of options indicates our confidence in a successful outcome for you.

Stage 3: Start the Collect Out

During this process, which we aim to complete within 90 days where possible, we will be utilising our full expertise in maximising Recoveries.

We report to you as often as you like, but as an absolute minimum, you will receive a detailed progress report for the previous month’s collections from us on the 5th of every month (or the next working day). This ensures you are always fully aware of the Position.

We also notify you immediately if we uncover something which will have a detrimental impact on Collections. We don’t shy away from delivering Bad News, as we appreciate that you need to know as soon as possible, especially before a report to Creditors is due.

Stage 4: Collect Out concluded

Be assured that we don’t close a case until the remaining Recoverable Amount is zero.

We don’t give up when the majority of the Ledger has been realised. We feel obligated to work it down to zero, however hard those last few debts may be!

Once we have concluded Collections, we will issue our Final Report and Invoice, and call you to ensure that you are happy with the outcome, before getting your agreement to close the case.

So if you need to assess the position quickly and accurately, contact us today for a Free Debtor Collateral Review

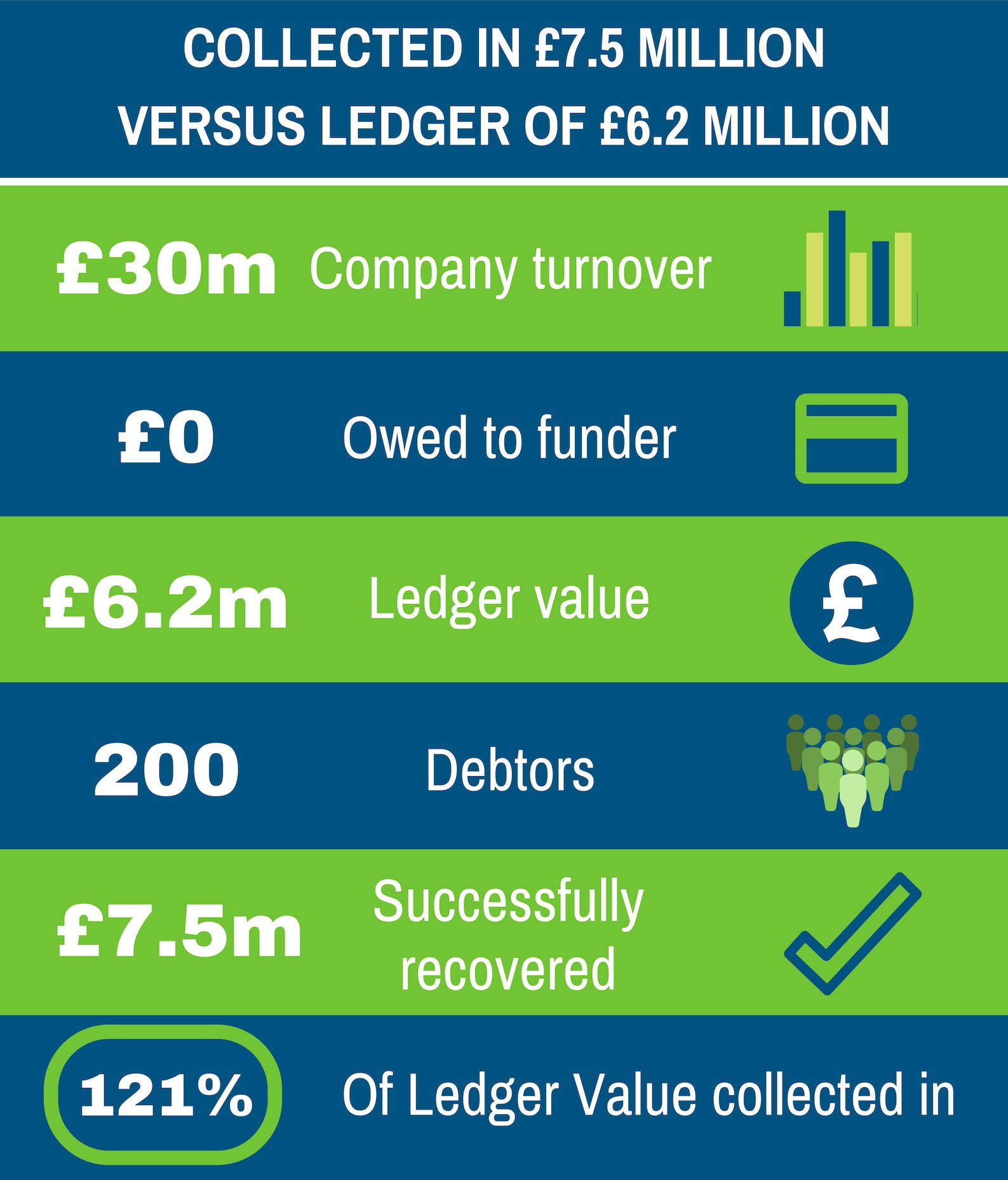

Case Study

Summary

We helped an Insolvency Practitioner recover £7.5m of the £6.2m Ledger value when a high profile Communications Company went into Administration. We dealt with the Collections ourselves, but also monitored and assisted Collections by the IP and the Company.

Facts:

A Birmingham based Communications Company was going into Adminstration with a Ledger value of £6.2m.

We were instructed by the Insolvency Practitioner and quickly established that the top 10 Debtors owed £5m of the Ledger. On our advice the Insolvency Practitioner agreed to deal with them, including invoicing the work-in-progress. We would monitor and assist their team whilst we would deal with the Collect Out of the remaining 190 debtors who owed £1.2m.

Actions:

We visited the site and collected all the books and records of the 190 Debtors we were dealing with. We started Collections immediately and reported and monitored regularly, including on the collections of the top 10 Debtors.

The work-in-progress on the top 10 Debtors increased the Debt by a further £1.5m and we provided the staff of the Company in Adminstration with support and advice to help them collect the majority of that £6.5m

Results:

Between Credebt, the on-site team and the IP we collected a total of £7.5m.

The Insolvency Practitioner was very pleased with our strategy, as we had not immediately looked to obtain the whole Ledger, as we deemed that in this instance it was not the right thing to do.

We will always give advice that is in the best interest of the case, not necessarily just in our own best interest as long-term relationships with Funders and Insolvency Practitioners are at the heart of what we do.

£7.5 Million Recovered

How can we help?

Credebt provide a full range of expert Receivables Management Solutions to the Insolvency Profession, the Invoice Finance Industry, Turnaround Practitioners, advisers and their clients, from full sales ledger recovery to outsourced credit control.

For more information about how we can help call 08456-6385256

or email our MD, Glen Morgan at glen@credebt.co.uk

“Credebt provide an excellent service and consistently update their clients on progress. They are prepared to be flexible on fee negotiations and have quickly instilled me with confidence in their ability to get the job done.

Glen and his team are tenacious, approachable and robust and have all the right attributes for a successful collection agent.”

our offices

Bristol Office

Credebt Ltd

Trym Lodge

1 Henbury Road

Westbury-On-Trym

Bristol

BS9 3HQ

Manchester Office

Credebt Ltd

2nd floor

3 Hardman Square

Manchester

M3 3EB

London Office

Credebt Ltd

Hamilton House

Mabledon Place

London

WC1H 9BD

Credebt Limited: Registered in England Number: 6933734 Registered Office: Trym Lodge, 1 Henbury Road, Westbury on Trym, Bristol BS9 3HQ

Data Protection License Number: Z1837677 | Credit Services Association Membership number: 804