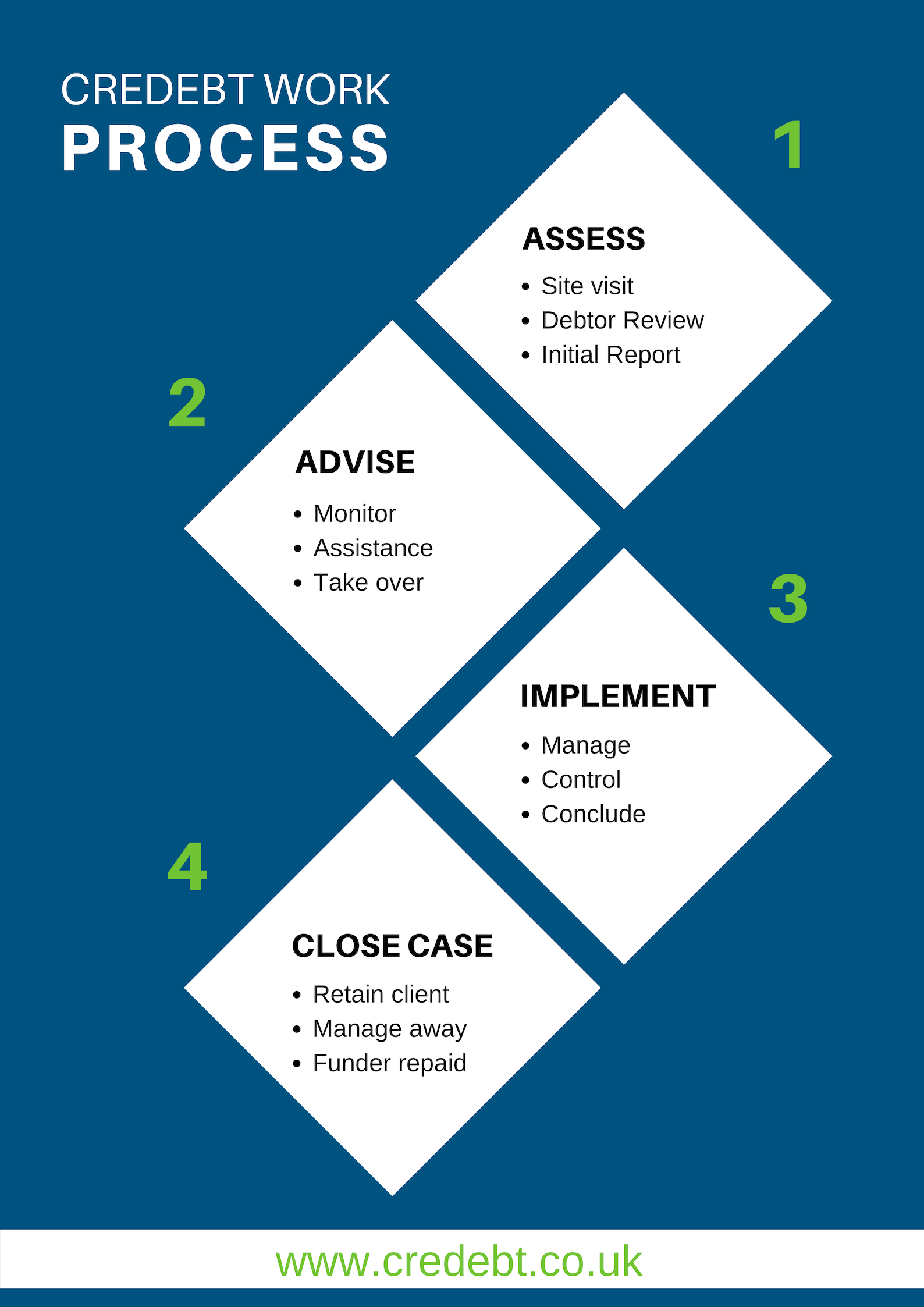

In this scenario we follow a 4-stage process as detailed below, which is proven to maximise the result for our Client, whatever the situation we find.

Stage 1: Debtor Collateral Review

Following an initial conversation, we always suggest that the first step is to get us out to site to carry out a comprehensive Debtor Collateral Review. We do this initial review at NO CHARGE to you, regardless of the outcome. It includes:

On-site visit usually within 24 hours but guaranteed within 48 hours, to thoroughly review the following:

-

Order to Cash process

- Aging Profile of the Ledger and movements over recent months

-

Details of any issues and queries

-

Backing paperwork and their validity

-

Staff, current and historical, and Procedures followed

-

Reconciliations being produced

-

Verification of Outstanding Balances if required

Whilst on-site, we will thoroughly analyse all aspects of the Debt that your Funds are secured against.

We call on our extensive expertise in all industries to find Fraud and report back the same day with the extent of the Fraud that has occurred.

We have spotted several Frauds that have been missed or unconfirmed by the Funder’s own Auditors, IBR providers and other firms carrying out Audits.

THERE IS NO CHARGE FOR THIS INITIAL VISIT, REGARDLESS OF OUTCOME

Stage 2: discussing our findings

Following our visit and report, there will be one of the following outcomes, each with a different solution.

1. Fraud found

When Fraud has been found, we will discuss a range of options that can include:

- Verification

- Taking over the Collections

- Improving Cashflow of the business to reduce Funds Out

- Moving into Collect Out

We will then deal with whichever is most appropriate, with the main aim to minimise or eliminate any potential losses for you.

2. No Fraud found

Providing we have found that without any doubt there is no Fraud, we will close the matter after discussing with the Funder the reasons why it was suspected.

Stage 3: IMPLEMENTATION OF SOLUTION

Whatever solution is required, we will work tirelessly to ensure that the Position is managed and controlled effectively.

We always work in the most appropriate way to manage the risks to your Capital, which doesn’t always result in us needing to take over responsibility for the Collections immediately, as in many cases it is not the right thing to do and would not result in the best outcome for you.

Our ultimate aim is Full Repayment of your Capital, whether that be via a Manage Away, Collect Out or stepped improvement to your Position until it is under control.

Stage 4: SUCCESSFUL OUTCOME ACHIEVED

We see things through to conclusion, whether that be a Manage Away, Collect Out or even Compilation of Evidence for legal action to commence against the business and its Directors.

Credebt will only stop working once we know that you, the Client, have achieved the best possible outcome from the situation, whatever that situation is.

If you suspect Fraud and would like us to become involved, please contact us to arrange a Free Debtor Collateral Review.

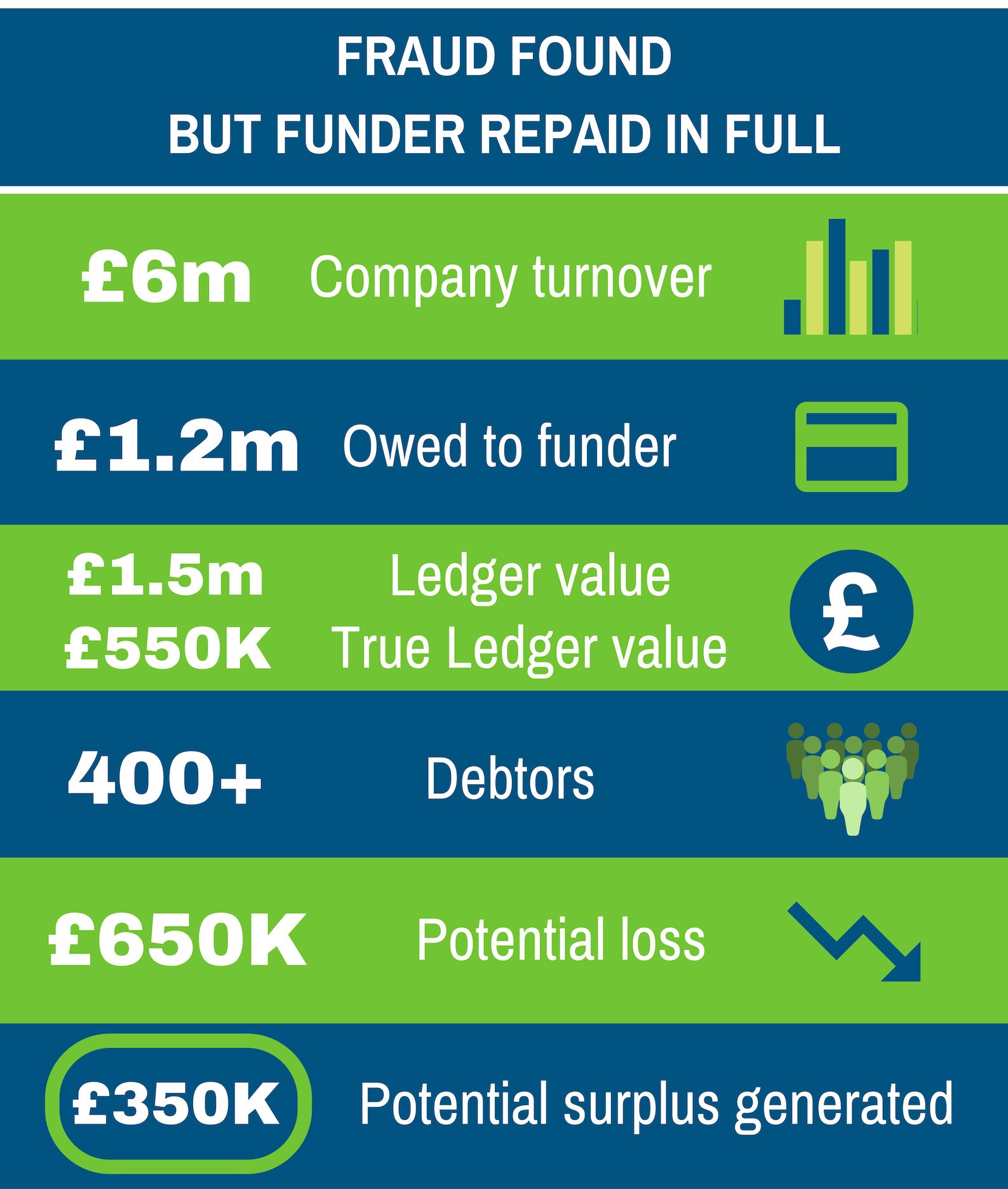

Case Study

Summary

We successfully assisted with a significant reduction in exposure and then a Manage Away when a Midlands Recycling Company had started Fresh Air Invoicing to cover up considerable gaps in their Cashflow.

Facts:

On the day we were instructed to carry out a Debtor Collateral Review the Invoice Funds Out Position was £1.2m with an alleged Ledger of £1.5m. The total debtors were over 400.

Credebt discovered that at least £35K was invoiced to companies that either no longer existed or that the client no longer traded with. A further £400K of invoices had been falsified in order to look legitimate. There were also significant queries against potentially valid invoices of £200K. The real collectable value of the Ledger was therefore £550K versus £1.2m Funds Out.

From the queried amounts we discovered that over £100K was raised to a competitor where the Directors knew each other very well and were both raising invoices to each other to maximise availability of their Invoice Finance Facilities.

Actions:

The decision was taken not to alert the Client to our findings, as this was more likely to result in a lack of co-operation and increase the chances of a shortfall.

Credebt took over the Collections and Monitoring of new invoices being raised, whilst working with the Client to agree and write and action write offs, and resolve all queries. The Client was quite obstructive as they realised that we must be aware of the true reason for the issues, but we worked over the next 4 months to improve things significantly.

Only Critical payments were allowed, and the Client was given Notice of Termination and agreed to sell the business as a result.

Results:

Within 4 months of our initial involvement, most invalid invoices had been written off, queries had been resolved and any new invoices uploaded were correct.

The Funds in use had been reduced from £1.2m to £600K whilst the Ledger had been largely tidied up and now reflected the true value owed to the Company at around £900K, although there was still some work to do.

This resulted in the business being sold to a business that didn’t require funding and our Client, the Funder, was repaid in full.

Funder repaid in full

How can we help?

Credebt provide a full range of expert Receivables Management Solutions to the Insolvency Profession, the Invoice Finance Industry, Turnaround Practitioners, advisers and their clients, from full sales ledger recovery to outsourced credit control.

For more information about how we can help call 08456-6385256

or email our MD, Glen Morgan at glen@credebt.co.uk

“We have instructed Credebt on several occasions to either assist with a collect out or provide a detailed view of the current position and have always been happy with the approach, response times and the end result which has resulted in us recovering our client’s funding position in full.

I would fully recommend Credebt’s services to any Funder needing support in a Collect Out situation where they are looking to maximise their client’s customer payments.”

our offices

Bristol Office

Credebt Ltd

Trym Lodge

1 Henbury Road

Westbury-On-Trym

Bristol

BS9 3HQ

Manchester Office

Credebt Ltd

2nd floor

3 Hardman Square

Manchester

M3 3EB

London Office

Credebt Ltd

Hamilton House

Mabledon Place

London

WC1H 9BD

Credebt Limited: Registered in England Number: 6933734 Registered Office: Trym Lodge, 1 Henbury Road, Westbury on Trym, Bristol BS9 3HQ

Data Protection License Number: Z1837677 | Credit Services Association Membership number: 804