So one of your clients has asked you for an over-payment, or an increase in their pre-payment percentage, but they haven’t explained why!

Or they have explained why, and that worries you!

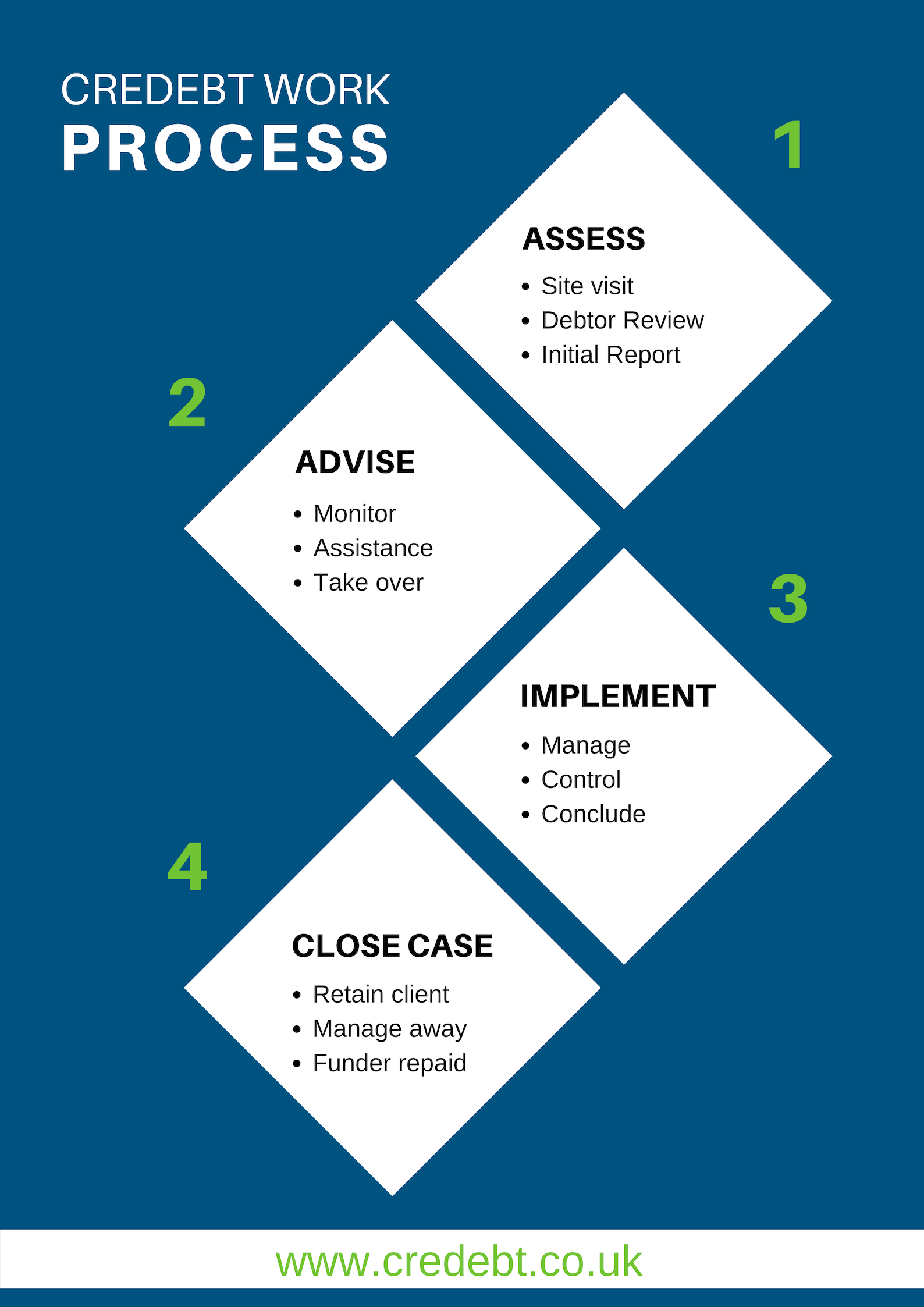

Credebt are regularly parachuted in at short notice to assess the situation and provide options, and even advise whether the request should be accepted or denied, and why.

We act fast and get on site to find the best solution whilst carrying out our Debtor Collateral Review.

Credebt have successfully assisted many Funders in this situation, and our Review will uncover the reasons for this request, if not already known.

Stage 1: Debtor Collateral Review

Following an initial conversation, we always suggest that the first step is to get us out to site to carry out a comprehensive Debtor Collateral Review. We do this initial review at NO CHARGE to you, regardless of the outcome. It includes:

On-site visit usually within 24 hours but guaranteed within 48 hours to review the following:

-

Copy invoices

-

Order to Cash process

-

Details of any issues and queries

-

Backing paperwork

-

Aged Debt reports

-

Customer Master File

Whilst on-site, we tidy up the Ledger and immediately produce a report which indicates the true collectability of the Ledger and whether you are likely to recover your Capital in case a Collect Out is needed.

This can only be accurately assessed once the Order to Cash process has been fully understood, which is why it takes experts to do this.

We also review Aged Creditors, Contras and other issues that may impact collectability and leave no stone unturned in reaching a realistic figure for Collections.

THERE IS NO CHARGE FOR THIS INITIAL VISIT, REGARDLESS OF OUTCOME

Stage 2: advise course of action

After the Debtor Collateral

1.

Recommended service: Monitoring Collections

2. Not collecting the Debt very well, but they have the resource to do it

Recommended service: Credit and Collections Policy and Procedures

3. Aged Debt unacceptably high

Recommended service: Assistance with Collections

4. Collections are not being dealt with at all, or not well enough

Recommended service: Take over Collections – Intensive Care

5. Significant Creditor pressure, which means potential Insolvency and Collect Out

Recommended service: Pre-appointment Credit Control

6. Business has stated this is very temporary and when no other issues have been found, it is agreed under certain conditions.

Recommended service: Controlling Funds Out position

Stage 3: review results

No two circumstances are the same, so we have to be agile in our approach and ensure we do what is best for you, our client, to manage the risk with the Debtor Book, and prepare for all possible outcomes, including potential Insolvency and therefore a Collect Out.

Depending on the course of action we will review the results of each and move on to the next stage if and when required. We will advise on all the options available and the potential outcomes for each, and make our suggestions as to what is required and how quickly.

Stage 4: CASE concluded

Be assured that we don’t close a case until you are 100% happy with the results. We see things through to conclusion, whether that’s a happy retained client, a manage away or a Collect Out. We will only stop working once we know that you are happy with the outcome.

All you need to do in this circumstance is to instruct us to carry out a Free Debtor Collateral Review and we will do the rest. This will include advice on whether the request for over-payment should be granted, and provide the reason it was requested, so you can make an informed decision.

How can we help?

Credebt provide a full range of expert Receivables Management Solutions to the Insolvency Profession, the Invoice Finance Industry, Turnaround Practitioners, advisers and their clients, from full sales ledger recovery to outsourced credit control.

For more information about how we can help call 08456-6385256

or email our MD, Glen Morgan at glen@credebt.co.uk

“I have instructed Credebt on several matters with our clients and have always been happy with the results. Their support and solutions for clients, who have a variety of issues and challenges, have always been of great benefit to them and to us.

I would recommend Credebt’s services to any Funder regarding Collect Outs and in Life Support for trading businesses.”

our offices

Bristol Office

Credebt Ltd

Trym Lodge

1 Henbury Road

Westbury-On-Trym

Bristol

BS9 3HQ

Manchester Office

Credebt Ltd

2nd floor

3 Hardman Square

Manchester

M3 3EB

London Office

Credebt Ltd

Hamilton House

Mabledon Place

London

WC1H 9BD

Credebt Limited: Registered in England Number: 6933734 Registered Office: Trym Lodge, 1 Henbury Road, Westbury on Trym, Bristol BS9 3HQ

Data Protection License Number: Z1837677 | Credit Services Association Membership number: 804