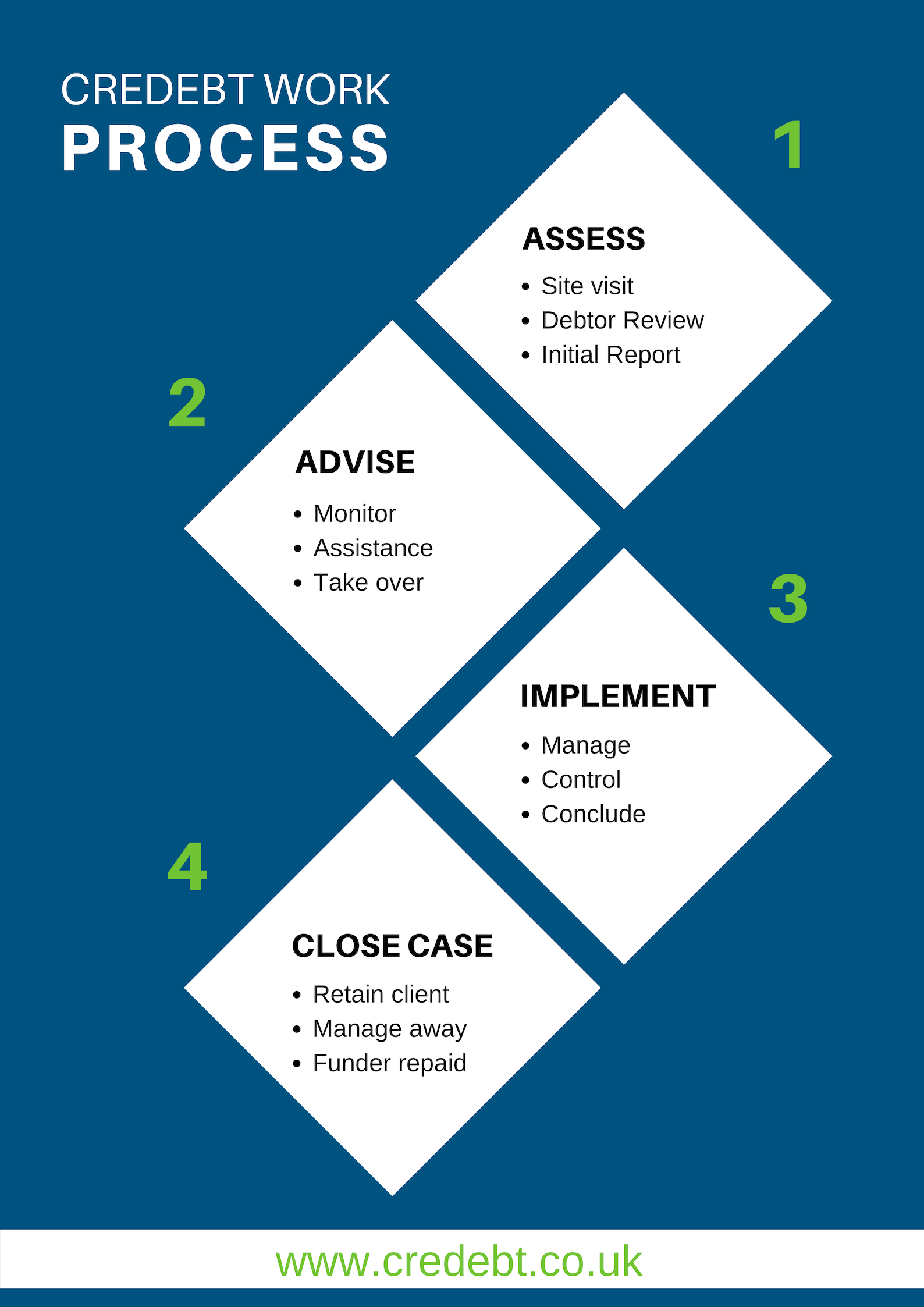

In this scenario, where the business has poor Credit and Cashflow Management and needs to generate cash fast to assist with turnaround, we follow a 4-stage process as detailed below, which is proven to maximise the result for our Client, whatever the situation we find.

Stage 1: Debtor Collateral Review

Following an initial conversation, we always suggest that the first step is to get us out to site to carry out a comprehensive Debtor Collateral Review. We do this initial review at NO CHARGE to you, regardless of the outcome. It includes:

On-site visit usually within 24 hours but guaranteed within 48 hours, to thoroughly review the following:

- Order to Cash process

- Aging Profile of the Ledger and movements over recent months

- Details of any issues and queries

- Backing paperwork and their validity

- Staff, current and historical

- Credit Policy and Procedures

Whilst on-site, we will thoroughly analyse all aspects of the Debt to understand why the Overdues are so high.

We call on our extensive expertise in all industries to look at the reasons for the Overdue Debt and provide actionable suggestions as to how to release bottlenecks on Cashflow.

Our MD, Glen Morgan, usually gets personally involved in these, as he has over 23 years’ experience in improving Processes and reducing Overdue Debt for clients, ranging from major Blue Chip Companies to SMEs, and he prides himself on being able to greatly assist in any business in any industry.

Following this initial review we will report on our findings and suggest the best possible next steps to get the business generating the maximum amount of cash quickly

THERE IS NO CHARGE FOR THIS INITIAL VISIT, REGARDLESS OF OUTCOME

Stage 2: Assistance

Assistance can range from monitoring collections through to taking over the Credit Management and Collections of the company for an interim period.

Following our visit and report, there will be one of the following requirements, each with a different solution.

1. Ledger Intensive Care and Policy & Procedure improvements

We can take over the Collections, either completely or for a period of time, and engage directory with your Client to improve things quickly.

Whilst doing this we will also review and improve all Collections processes, Query Management and even assist with Staff changes and Recruitment to make your Client fit for purpose and able to deal with Collections effectively on an ongoing basis.

2. Assistance required with some old stubborn Debts and Debtors

We will accept a partial instruction to maximise recoveries from just the 90-day-plus Debtors, the ones that you have already disapproved and therefore 100% of the money is due to your Client. This improves Cashflow very quickly.

3. Fresh Air Invoicing discovered

Please see our range of services as detailed on our Irregular Audit or Fraud Suspected Scenario pages.

4. Prepare for Collect Out

We will carry out all the required preparations for a Collect Out, as detailed in our Prepare for Collect Out page.

During this time we report regularly to all stakeholders and ensure that all know the current position and future predicted cash position of the business.

Stage 3: support

Once the DSO and aging has been significantly reduced we will put in place systems to prevent reoccurrence.

At this stage we can also help with writing policies, recruiting staff or providing ongoing Credit Control support ourselves until all stakeholders are happy for us to disengage.

Whatever solution is required, we will work tirelessly to ensure that the cashflow is improved rapidly.

This can be on-site or remotely, whichever works best. We have dedicated phone lines to ensure confidentiality when required, although some Clients prefer the impact of disclosing our involvement.

Our ultimate aim is to either improve things quickly and provide the tools to prevent issues from re-occurring, or provide a safe landing into Collect Out by providing Pre-Appointment Credit Control for as long as required.

Stage 4: worst case scenario

If, despite our efforts and that of the Turnaround Practitioner instructed, the business cannot be saved, we can then move into Collect Out mode and maximise recoveries for the funder, bank or any other stakeholders in a formal insolvency.

Once the appropriate solution has been implemented, we will disengage, but keep in contact with you and your Client, to ensure that the improvements (reduced Debt, improved processes, etc.) are maintained.

Credebt will only stop working once we know that you, the Client, have achieved the best possible outcome from the situation, whatever that situation is.

Contact us today to arrange your Free Debtor Collateral Review and we’ll take it from there.

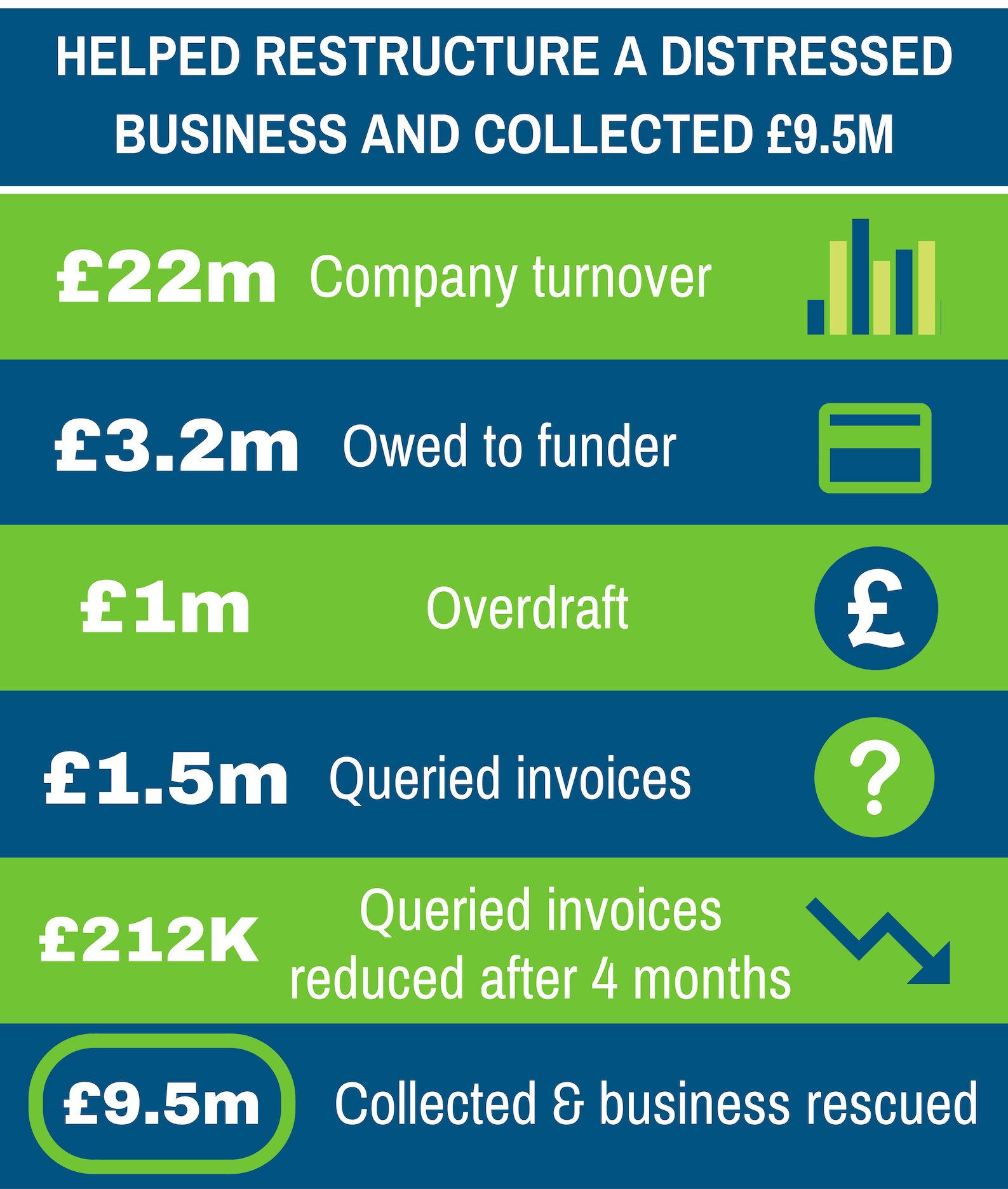

Case Study

Summary

For a South East based Toiletries Business, Credebt greatly improved the overall Debtors position, reduced Debts, took over Collections, assisted with Staff Recruitment and wrote a Credit Policy and Procedures from scratch for the company to follow.

Facts:

The family run business had grown from £12m to £22m in 12 months and was making a substantial loss while doing so. This was due to their internal controls being extremely poor.

They owed £3.2m on their Invoice Finance Facility and had a £1m overdraft.

We were instructed by the Bank’s Invoice Finance Team, as well as the Main Bank and an Insolvency Practitioner, to get the Ledger Management under control and reduce the Overdue Debt as soon as possible. We worked alongside an IFT Member throughout the process as he endeavoured to improve the rest of the business operations whilst we focused on cash generation.

Once this was complete, it was agreed that we would create a Credit Policy and Procedures Manual, and assist with implementation, as well as Staff Recruitment.

Actions:

Credebt engaged directly with the Company and took over the Ledger in its entirety. We spent 3 months maximising the Cash Collection, whilst reviewing and reducing all bottlenecks with the Order to Cash process.

Two members of our Team were on-site several times each week to work through queries. Remote access to invoice, pad and bank systems were obtained to work as efficiently as possible.

We met up with some of the largest customers to assist with query resolution and we set up an adequate and effective Query Management System.

For the first month, we reported back to all stakeholders daily, and weekly after that. We had conference calls or physical meetings to go through issues every morning at 10am for the first four weeks, and at least twice a week after that.

Results:

We collected £9.5m in 3 months, whilst reducing the Invoice Finance Facility down to £1.8m. Queried invoices were reduced from £1.5m to £212K.

We wrote a robust Credit Policy and Procedures Manual, which ensured the Company was Invoice Finance compliant. We assisted with monthly reconciliations and repaired the relationship between the Company and the Invoice Finance Provider.

We helped them recruit 2 Credit Control staff, using our expertise to find the right people for the job. We conducted the interviews and prepared their job specifications.

We exited the business after nearly 4 months as they were now in a position to successfully cope themselves.

£9.5m COLLECTED

How can we help?

Credebt provide a full range of expert Receivables Management Solutions to the Insolvency Profession, the Invoice Finance Industry, Turnaround Practitioners, advisers and their clients, from full sales ledger recovery to outsourced credit control.

For more information about how we can help call 08456-6385256

or email our MD, Glen Morgan at glen@credebt.co.uk

“Glen is full of energy and gets results – fast. I would have absolutely no hesitation in recommending Glen and Credebt to my clients.”

our offices

Bristol Office

Credebt Ltd

Trym Lodge

1 Henbury Road

Westbury-On-Trym

Bristol

BS9 3HQ

Manchester Office

Credebt Ltd

2nd floor

3 Hardman Square

Manchester

M3 3EB

London Office

Credebt Ltd

Hamilton House

Mabledon Place

London

WC1H 9BD

Credebt Limited: Registered in England Number: 6933734 Registered Office: Trym Lodge, 1 Henbury Road, Westbury on Trym, Bristol BS9 3HQ

Data Protection License Number: Z1837677 | Credit Services Association Membership number: 804